Summary

Getting Started: A step by step guide to confirm your eligibility!

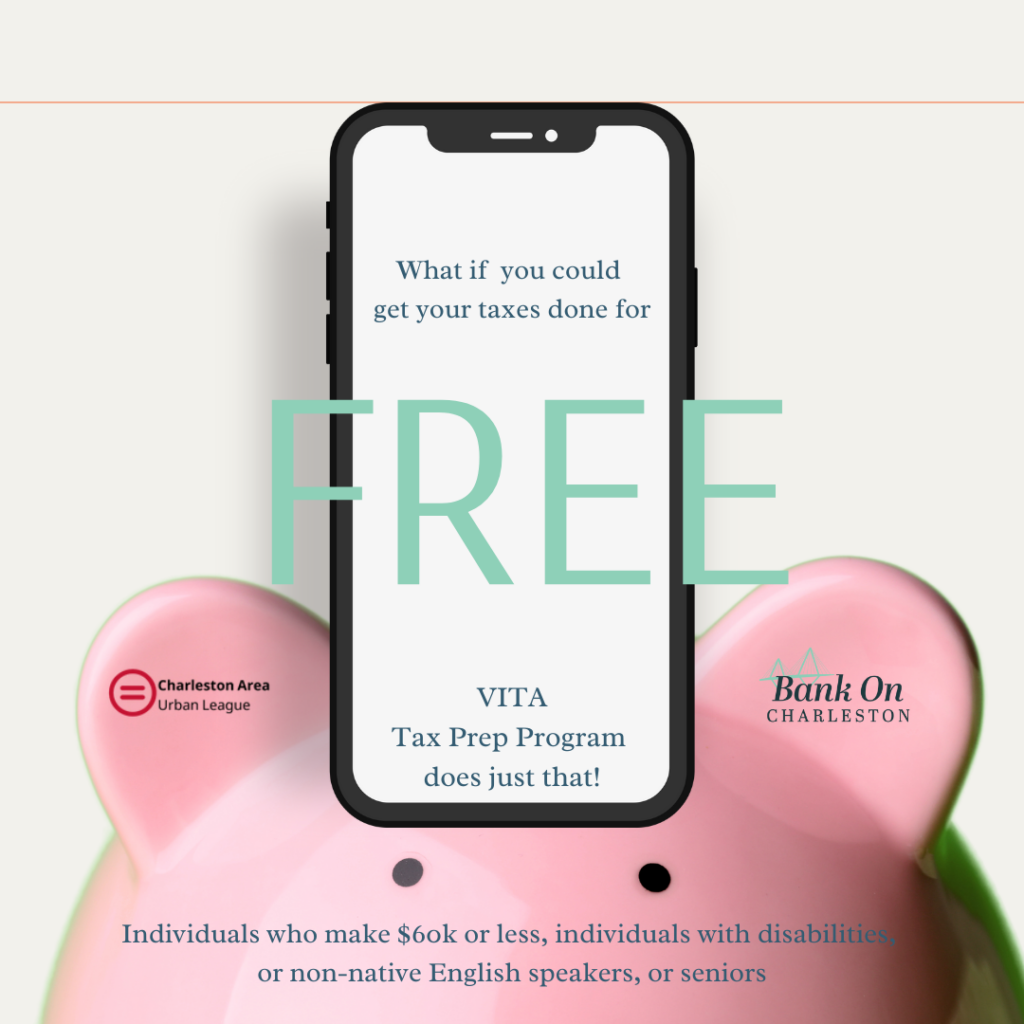

The IRS Volunteer Income Tax Assistance (VITA) and the Tax Counseling for the Elderly (TCE) programs offer free tax help and e-file for qualifying taxpayers.

Getting Started: A step-by-step guide to confirm eligibility!

- Step 1: Bookmark or print out the IRS Guide to reference how Free Tax Return Preparation works

- Step 2: Determine if filing electronically or manually filled forms works best for you (electronically is preferred for a quicker return!)

- Step 3: Next, determine if you qualify for VITA’s Tax Preparation Services! Quick Guideline Details Here!

- Step 4: Once you’ve determined your eligibility, it’s time to file! This is the fun part (we promise!) Bank On Charleston partners offer FREE in-person workshops or online tutorials to walk you through the process. VITA Locator Tool

- Step 5: Gathering your documents. This checklist details exactly what you need to file!

- Step 6: SAVE THE DATE! You can file as early as January 18, 2024